Cancel

Blog

CATEGORIES

- Miniature Bearings(2)

- Thin Section Bearings(1)

- Ceramic Bearings(7)

- Stainless Steel Bearings(3)

- Needle Roller Bearings(3)

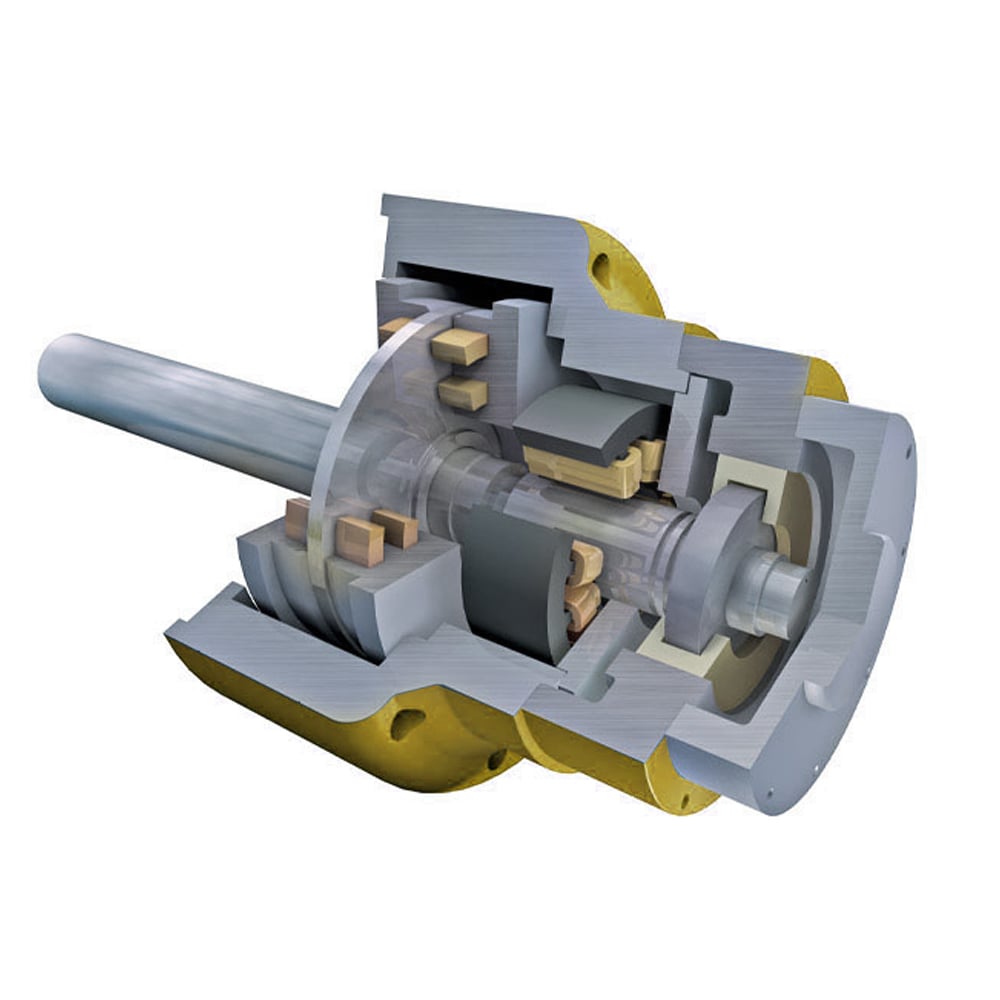

- Spherical Roller Bearings(1)

- Thrust Ball Bearings(2)

- Roller Bearings(1)

- Tapered Roller Bearings(2)

- Slewing Ring Bearings(2)

- Angular Contact Ball Bearings(1)

- Sleeve Bearings(1)

- Others(44)

- Low Temperature Bearings(1)

- Ball Bearings(9)

- Bearing Load(4)

- Bearing Components(1)

- Types of Bearings(4)

- Thrust Bearings(1)

- Bearing Technical Knowledge(20)

- Aerospace Bearings(2)

- Polyurethane Rollers(2)

- Cam Follower(3)

- Linear Bearings(1)

- Spherical Bearings(1)